Breaking Down the Budget

BUDGET/TAXES

Democrats Pass $55.2 Billion Budget

Another year, another budget, and another round of tax hikes on working families.

Just before midnight on the last day of the legislative session, Illinois House Democrats passed the FY26 budget that will cost taxpayers more than $55.2 billion, a $2 billion increase over last year.

State spending under Governor Pritzker has grown exponentially since he took office in 2019. When he took over as Governor, state expenditures were $40.3 billion. Each year since we have seen state spending grow and we now have a budget that is $15 billion higher than when he took office.

When Governor Pritzker delivered his Budget Address in February, he said, “If you come to the table looking to spend more – I’m going to ask you where you want to cut.”

So much for that sound bite. The newly passed budget contains $1 billion in tax hikes and fund sweeps to pay for new spending, pork barrel projects for Democrats, and pay raises for politicians.

For several years in a row, the Democrats have negotiated spending plans behind closed doors, excluded Republican input, rejected accountability, and raised taxes on Illinoisans in order to quench their never-ending thirst to spend more money.

House Republicans have repeatedly offered to work with the majority party to craft a balanced budget without tax hikes, but were once again completely shut out of the process.

Democrats succeeded in incorporating near-record spending and huge tax hikes in the FY26 budget, showing no fiscal restraint and failing to implement structural reforms. Democrats even rewarded themselves with hundreds of millions in pork projects and a big fat pay raise for politicians in the budget. All on the taxpayer’s dime.

State Representative Mike Coffey says each year Democrats miss their target to help the citizens of Illinois.

“In a time when Illinois families are in dire need of tax relief, the Democrats failed to pass a reasonable budget to serve the best interests of the people of Illinois,” said Coffey. “Serious issues impact our state’s economy and growth, but Democrat politicians double down on raising taxes to fund their own pay raises and special pork projects in their districts.”

$1 Billion in New Taxes and Fund Sweeps

The $55.2 billion budget for Fiscal Year 2026 is reliant on one-time revenues and a billion dollars in tax hikes and fund sweeps.

The Budget and Revenue Package consisted of three major components:

- FY26 Budget Appropriations – SB 2510

- FY 26 Budget Implementation Bill (BIMP) – HB 1075

- FY 26 Revenue Package – HB 2755

Democrats imposed a laundry list of new taxes and money was swept from dedicated funds paid for by user fees to prop up the Democrats’ wasteful spending.

Ultimately, Democratic lawmakers voted to raise their own pay, impose new taxes, and make life in general a lot more expensive for already cash-strapped Illinois taxpayers.

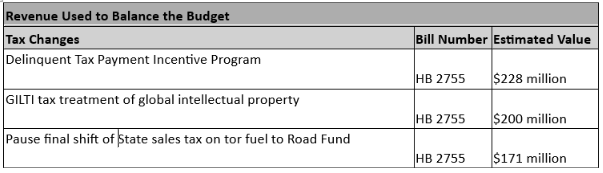

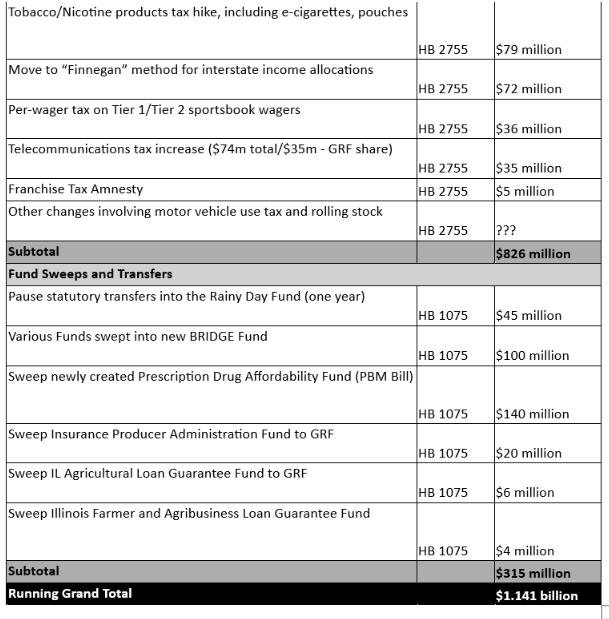

Below is a list of major revenue changes that were included as part of the FY26 budget, which includes tax increases, fund sweeps, pauses in statutory transfers, among other items.

CONSUMERS

Controversial ‘swipe fee’ delayed for one year

In a last-minute move, a massive change being imposed by the State of Illinois on Illinois consumers who use credit cards was delayed for one year. The controversial ‘swipe fee’ law would ban financial institutions that issue credit cards from imposing a fee on the retailers that accept these credit cards for use in Illinois. The law was enacted in May 2024 for implementation this year.

For complex legal reasons, this ‘swipe fee’ law is entangled with the transactions on which an Illinois State sales tax is collected. This would create a complex and snarled situation in which a transaction could be fee-imposed and taxed in two separate categories depending on the sales tax applicability of each transaction. An especially ugly scenario arose with respect to food service transactions, where it appeared likely that implementation of the controversial ‘swipe fee’ law could require many Illinois consumers who use their credit cards at table-service restaurants to run their cards twice, once for the meal and once for the service fee or tip paid to personnel. The action by the Illinois General Assembly to delay implementation of the ‘swipe fee’ does not make this law go away; its implementation has been ‘paused’ for one year. This debate will continue into the 2026 spring session.

FIREARMS

House Republicans Vote to Protect the Rights of Law-Abiding Gun Owners, Stand Against Unconstitutional Storage Restrictions

State Representative Mike Coffey issued the following statement after Republicans voted NO on Senate Bill 8 and House Bill 850 late Wednesday evening. He cited serious constitutional concerns for the rights of law-abiding gun owners.

“Senate Bill 8 is another bill crafted by Democrats to target law-abiding gun owners and restrict their Constitutional Rights,” said Coffey. “This bill will not only affect homeowners, but hunters and CCL holders too. We all want safer communities, but state government is overreaching again with this bill and it creates more confusion and includes civil penalties to responsible gun owners which is why I voted no to the measure.”

Senate Bill 8, also known as the Safe Gun Storage Act, imposes new mandates requiring gun owners to store firearms in locked containers when in the presence of minors, prohibited persons, or so-called “at-risk” individuals. Additionally, SB 8 requires gun owners to report stolen firearms within 48 hours or face civil penalties, despite most gun owners already acting responsibly and taking such steps voluntarily.

House Republicans also raised alarms about a provision that gives greater Second Amendment rights to non-residents transporting firearms through Illinois than to state residents themselves.

House Bill 850 makes changes to Illinois’ Clear and Present Danger statute in a way that strips due process protections and will lead to further constitutional violations.

The Democrat playbook highlighted their approach to getting HB850 the House Floor by waving a public Committee hearing. House Republicans argue the bill creates legal cover for unconstitutional firearm policies and gives the state authority to revoke FOID cards without a formal hearing and and due process.

After legislative session adjourned Wednesday night, House Minority Leader Tony McCombie released the following statement:

“Democrats spent more time extolling the virtues of violating federal immigration laws than they did taking away the Second Amendment rights of law-abiding gun owners.”

The fiscal issues in Illinois are not new. Our state does not have a revenue problem, it has a major spending problem, year-after-year. Ultimately, Democratic lawmakers voted to hike their own pay, raise new taxes, and make life in general a lot more expensive for already cash-strapped Illinois taxpayers.

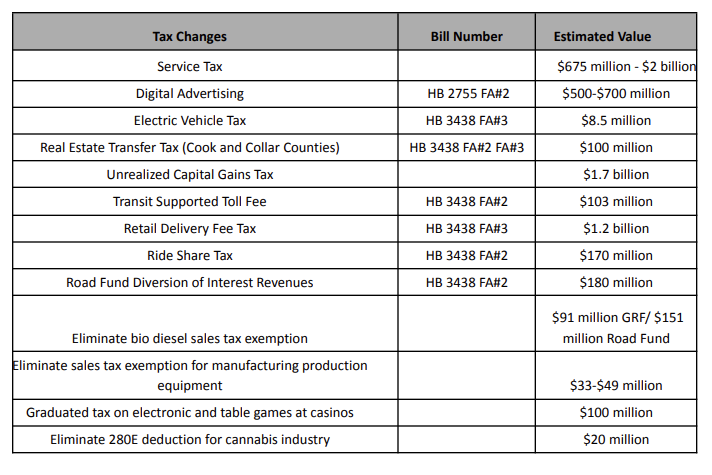

Tax Increases Not Included

Below is a list of revenue items that were being actively discussed this spring in an effort to close the budget gap, or fund mass transit. These items could be brought back to life during Veto Session or when the legislature next adjourns. We will be keeping a close eye on the never-ending tax increases proposed by Illinois Democrats.

Contact Rep. Coffey’s office with any questions: 217-782-0053 or [email protected]