TAXES

Record property tax increases slam Chicago homeowners. Chicago homeowners are being walloped with a record property tax hike, with some of the city’s poorest neighborhoods absorbing the steepest increases even as downtown office owners see their bills fall, according to new data from the Cook County treasurer’s office.

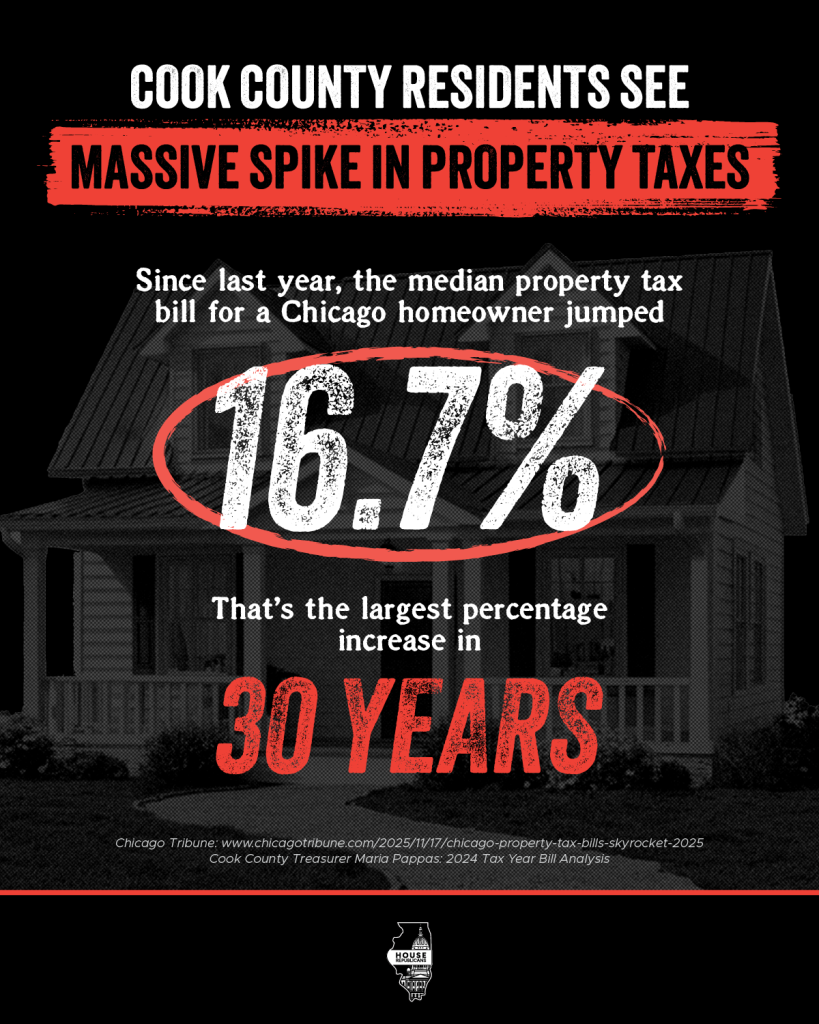

An analysis from Cook County Treasurer Maria Pappas’ office found the median property tax bill for a Chicago homeowner jumped 16.7% since last year, the largest percentage increase in at least 30 years. The surge follows similar spikes in Cook County’s north and south suburbs over the last two years and complicates the job of the Chicago City Council as it considers tax hikes to help close a historic budget gap.

The long-awaited second installment of Cook County property tax bills was mailed to property owners on Friday and is due Dec. 15. Across the county, residential and commercial property owners are being billed a total of $19.2 billion, a nearly 5% increase from last year. But the burden is falling unequally. […]

As the Illinois Answers Project and Chicago Tribune reported in September, homeowners on the South and West sides were bracing for property tax hikes after sharp assessment increases in many of those neighborhoods. The treasurer’s report confirms those fears — and highlights another powerful force behind the shift: a steep drop in the value of Loop office towers, retail properties, hotels and restaurants. The collective tax bills for those commercial properties dropped by $129 million, driven by plunging property values, effectively shifting more of the tax burden onto Chicago’s homeowners.

“When you have a vacancy rate in commercial properties the way we do in the city right now, commercial (valuations are) going to go down,” Pappas said in an interview Friday. “So, who has to pick it up? It’s like a scale. If … one side goes down, the other goes up.”

Median residential bills in nine predominantly Black Chicago community areas jumped by more than 50% compared with last year, according to the treasurer’s analysis. In West Garfield Park, the median homeowner’s bill more than doubled, rising from $1,482 to $3,448. North Lawndale saw a similar hike, with the median bill increasing from $1,905 to $3,791.

The median residential bill in the Chicago community areas of Englewood, West Pullman, West Englewood, Fuller Park, New City, East Garfield Park and Riverdale each increased between 54% and 82%. Even outside those neighborhoods, South and West Side homeowners faced steeper increases than the rest of the city.

Skyrocketing property taxes make it impossible for Illinoisans to achieve the American dream of homeownership. We must make Cook County and our state a more affordable place to live, work, and grow by passing legislation that immediately lowers property taxes.

Read more from the Chicago Tribune.

BUDGET

No Plan, No Transparency: Pritzker’s Executive Order Still a Mystery. In September Governor Pritzker signed Executive Order 2025-05, directing state agencies to identify immediate spending reductions by October 23rd. He has yet to release any details about these proposed cuts.

The Executive Order directing Pritzker’s agencies to identify spending cuts stands in sharp contrast to the record-high budget Democrats passed in May, one that raised taxes, swept dedicated funds, and funneled hundreds of millions into pork projects in Democratic districts. The Governor happily signed this budget into law and proudly promoted it.

With no results released from the Executive Order, House Minority Leader Tony McCombie filed a Freedom of Information Act request on October 23rd. But on November 6th, the Governor’s office denied House Republicans’ request, claiming the information was merely “internal deliberations.”

In response, House Minority Leader Tony McCombie released the following statement:

“The Governor doesn’t need an executive order to control state spending. He already has full authority to manage his agencies. So why issue one? It was a political move to gaslight Illinois families into thinking he’s suddenly serious about fiscal discipline. Weeks later, he still hasn’t released a single detail. No plan. No transparency. No accountability. I’ll keep calling this out, because taxpayers deserve the truth, not political stunts.”

Read more about the Executive Order here.

Illinois’ strained budget faces significant, multi-billion-dollar SNAP challenge

The federal/state “food stamp” system, called Supplemental Nutritional Assistance Program (SNAP), could soon put a massive, multi-billion-dollar strain on Illinois’ already struggling budget. SNAP eligibility is determined by a household’s income, the size of a household’s family, and other factors. Most of the cost of these SNAP credits are paid by the U.S. federal government.

All 50 states are enrolled in the SNAP program, and each state has designated a social-work agency to perform these interview functions and enroll households in the program. In Illinois, it is the Illinois Department of Human Services (IDHS) that does this work. The IDHS agency operates help centers, conducts interviews, and signs people into the SNAP program.

The 50 states that have signed up for SNAP have all agreed to take on the administrative costs and burdens of administering the program, including eligibility enforcement. The social workers who sign people up for SNAP are supposed to verify the eligibility of each person who is admitted into the program. Recent studies have shown, however, that some states including Illinois, have built up what is called an “error rate.” This is a legal phrase that means that some of the households that have signed up for SNAP are getting benefits for which they are not eligible. With the goal of reducing the U.S. federal budget deficit, Congress earlier this year enacted a series of sanctions upon noncompliant states.

With a current error rate above 10%, Illinois is highly liable for the imposition of SNAP sanctions. These sanctions could include reduction in the amounts of money paid to Illinois to help fund the SNAP program, a severe reduction in these same payments, or the complete elimination of these payments. This would be a federal penalty against Illinois of up to $4.7 billion per year. The SNAP payments, which are a cash flow of at least $350 million/month, are an essential element of continuing operations for many Illinois households and the retailers who accept SNAP benefits. The U.S. Department of Agriculture (USDA), which administers the federal end of the SNAP program, has adopted a “no forgiveness” policy against the improper awards of SNAP benefits. The IDHS has informed legislators that the USDA is currently scrutinizing Illinois SNAP enrollments, with enforcement of federal penalties a distinct and immediate possibility.

Illinois General Assembly panels, including Illinois House – Appropriations/Health and Human Services (HAPH) and the Joint Committee on Administrative Rules (JCAR), have questioned IDHS senior personnel about the urgent need for Illinois to clean up SNAP enforcement and reduce its plus-10% eligibility error rate. Although the Department has responded that they are aware of the problem and are taking unspecified steps to correct it, the imposition of severe penalties against Illinois taxpayers remains a distinct possibility.

ENERGY

ICC approves another hike in Ameren natural gas rates. 2.3 million customers, including many homes in Downstate Illinois, are slated to pay $150 million more for the natural gas many of them use for cooking and heating. The rate hike was awarded to Ameren, the major St. Louis-based utility holding company that provides electricity and natural gas to much of Downstate Illinois.

State Rep. Mike Coffey said Illinois needs to create a better energy plan:

“There is a smarter path forward in Illinois to produce cheap and efficient energy, but we have to look at the reality of our current situation and the red flags that point to higher demand and less production,” Coffey continued to say. “When you look at the big picture, Illinois does not have the power to supply AI data centers, residential homes, and businesses. The economic reality of mandating electrification in Illinois is sinking in, and it’s created a financial burden on everyone in our state.”

Other Illinois customers buy natural gas from Chicago-based Peoples Gas (a subsidiary of the WEC Energy Group) and from suburban Chicago-based Nicor Gas (a subsidiary of the Southern Co.) and North Shore Gas (a subsidiary of Peoples Gas). All three firms have recently sought, or are seeking, natural gas rate hikes.

The ICC-approved rate hike for Ameren natural gas customers was announced on Wednesday, November 19.

HIGHER EDUCATION

Nearly 190,000 students enrolled in Illinois public universities. The consolidated figures for Illinois’ twelve public four-year colleges and universities reached a 10-year high, with 189,791 students enrolled. These numbers were paced by a 6.8% increase in first-time enrollments by freshman and first-year students intending to study full-time. The headcounts of dual-enrollment students, and transfer students, to Illinois public four-year colleges and universities also increased.

Illinois public college institutions have taken steps to expedite the process that Illinois students use to apply for and get admitted to Illinois public colleges and universities. The One Click College Admit webpage contains sub-pages oriented towards high school seniors, and towards high school juniors who are starting to look at their next steps. High school juniors are urged to open an account with OneClickAdmit, and seniors are urged to update their existing accounts. The program will expand in January 2026 to cover community college students who want to transfer to a four-year institution. [Note: The University of Illinois Urbana-Champaign (UIUC) and the University of Illinois at Chicago (UIC) are members of the Common App system and are not members of the One Click Admit program.]

Not all of Illinois’ twelve four-year public colleges and universities show good enrollment numbers in fall 2025. Macomb-based Western Illinois University (WIU), and Normal-based Illinois State University (ISU), with their geographic ties to economically and population-challenged Central and Western Illinois, continued to post flat or negative enrollment numbers in fall 2025.

OUTDOOR SPORTS

Firearm Deer Season in Illinois. A second round of firearm deer hunting will be coming in two weeks, from December 4 through 7.

During Firearm Season, hunters can use shotguns, muzzleloaders, handguns, and centerfire rifles. Vertical, traditional, and crossbows can also be used, but only on private property. Hunters also must adhere to clothing requirements, which call for a solid blaze orange or blaze pink hat and an outer garment that displays at least 400 square inches of orange or blaze pink material.

Hunting hours during this period are one-half hour before sunrise to one-half hour after sunset. Hunters must also have proper deer permits and a valid hunting license. The bag limit is one deer per hunter, and over a 12-month period that begins on July 1, no hunter may harvest more than two antlered deer. Upon killing a deer, hunters must adhere to reporting/registering guidelines as outlined by the IDNR. Find license and permit information here.

THANKSGIVING

Wishing all a Happy Thanksgiving. The four-day Thanksgiving weekend is traditionally the heaviest travel period of the year. As in previous years, the Illinois State Police is working with local police departments and sheriffs to increase holiday enforcement of moving violations and DUI’s. Please take your time and drive safely to and from Thanksgiving celebrations.

State Representative Mike Coffey wishes you all a safe and Happy Thanksgiving!