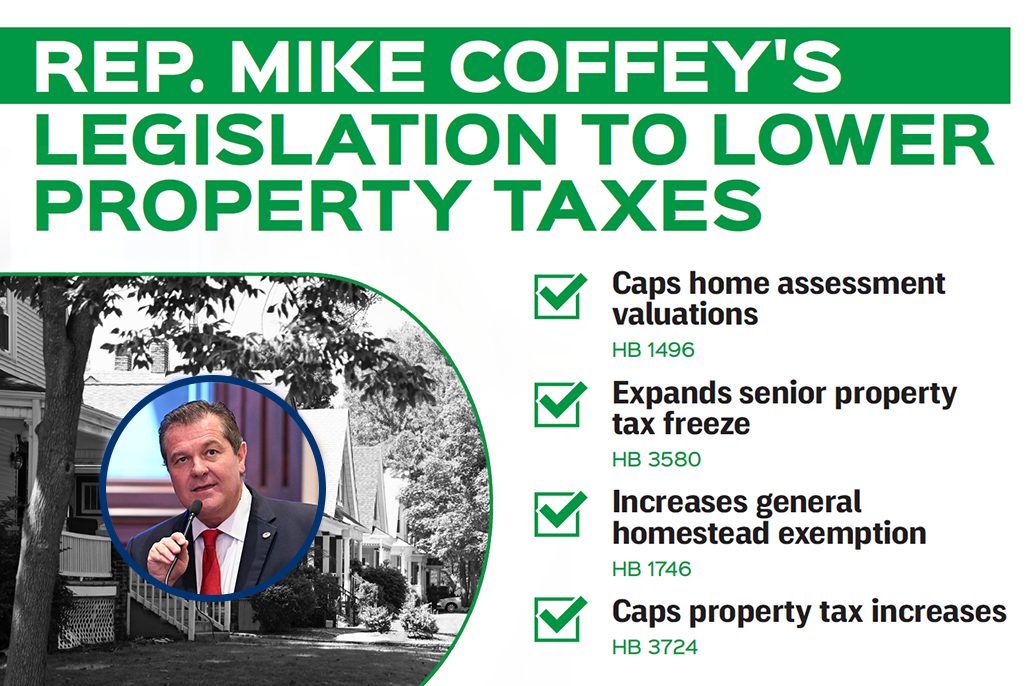

Property taxes in Illinois are out of control, and Rep. Mike Coffey knows we can do better. Residents are being taxed out of Illinois, and Rep. Coffey is working to reverse the trend and bring families and businesses back to this state.

Through his legislation, Rep. Mike Coffey is fighting to make Illinois a better place to live and work.

HB1496: The valuation of property in any general assessment year may not exceed 101% of the value of the property in the previous tax year if the property is residential. This bill caps home assessment valuations.

HB3580: Taxable years 2026 and thereafter, the maximum income limitation for the low-income senior citizens assessment freeze homestead exemption is $75,000 for all qualified property. This bill will expand the senior property tax freeze and offer seniors much needed relief.

HB1746: The term “maximum income limitation” for the low-income senior citizens assessment freeze homestead exemption means the greater of $80,000. This bill increases the general homestead exemption for 2026 and thereafter.

HB3724: A total tax bill for property receiving the General Homestead Exemption may not exceed 103% of the total property tax bill for the property for the immediately preceding taxable year. This measure ensures property tax increases have caps.

State Rep. Mike Coffey Demands Action on Soaring Property Taxes

Springfield, IL…State Representative Mike Coffey (R-Springfield) says Illinois must address the crisis of high property taxes in Illinois. As property taxes and homeowners’ insurance continue to soar, it’s becoming very clear that current public policy is damaging for homeowners across the state. Rep. Coffey wants to see immediate action taken from the General Assembly to address the rising costs of owning a home…READ MORE.